In the past, I’ve been a pretty vocal critic of the barbarous relic, but I want to clear up a few things. I am not anti-gold, I have no view on its fundamentals or what it might do in the event that the economy does X, Y, or Z. What I am vehemently against are the people who think gold is the solution for everything, particularly everything bad that can happen. These charlatans are financial predators of the highest order, preying on the financially illiterate and selling promises they can’t deliver.

“Worried about an economic meltdown? Buy gold.”

“Is the Fed’s printing press going to make fiat currency worthless? Buy gold”

“Is geopolitical risk keeping you up at night? Buy gold.”

Barring a steep correction between today and the close on Thursday, I will buy GLD in my Roth IRA. The purchase will represent 10% of my liquid net worth. I’m not buying gold for any other reason than it is going up. Let me explain.

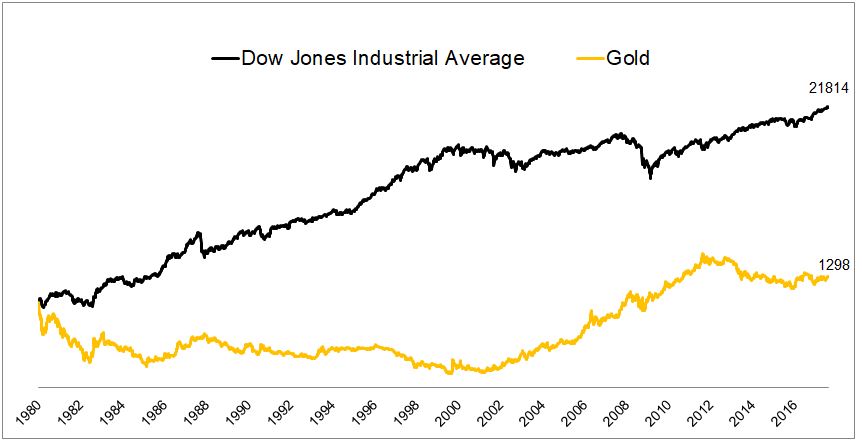

I’ve shared this admittedly cherry-picked chart in the past to support my view (which hasn’t changed) that gold is a great trading vehicle, but it is not a great long-term investment. In 1980, gold and the Dow were both 800. Today, the Dow is almost 17x the price of Gold, with dividends its 79x!

Prior to 1980, gold had wrapped up what Peter Bernstein called an “extraordinary episode in financial history.” From 1968-1980, it gained 30% a year. For context, not that a 30% CAGR for 12 years needs any, but stocks have never witnessed anything like this. In 1980, following this incredible performance, there was $1.6 trillion invested in gold. The market cap of all U.S. stocks was $1.4 trillion!

Back to today…

…Gold is poised to close above its 12-month moving average for the second straight month. Going back to 1970, the average monthly return for gold following a close above the 12-month moving average is 1.47%. The average monthly return following a close below the 12-month moving average is -0.15%.

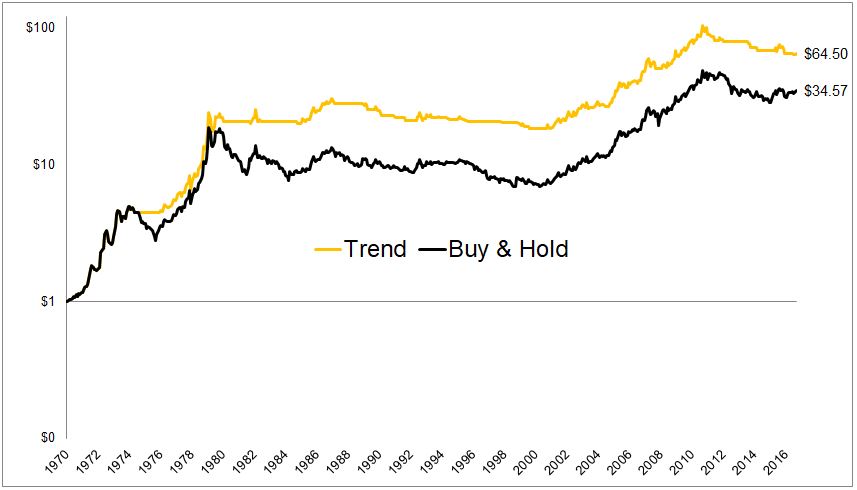

If you used the simplest of trend-following methods, investing in gold when it was above its 12-month moving average, and going to cash when it is below, the results would have been far better than just buying and holding gold.

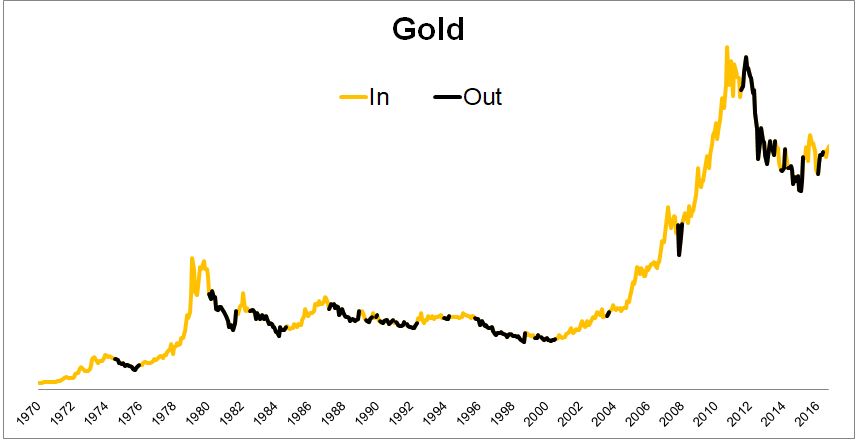

The chart below shows when you would have been invested in gold and when you would have been out. Granted, prior to GLD, this could only have been done with futures contracts, or gold bullion, with the former adding a degree of leverage that I would not have been comfortable with, and the latter adding a degree of paranoia that also would have made me uncomfortable.

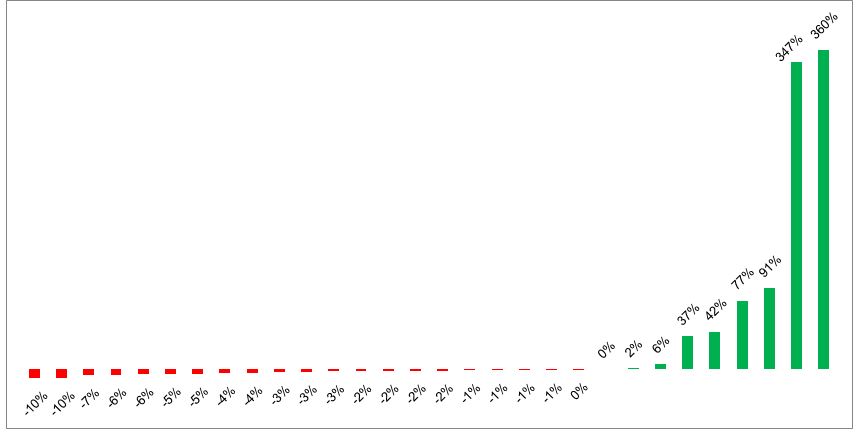

The chart below shows the hypothetical results from each of the 30 exits following an entry (going back to 1970). Using these rules would have resulted in a loss two-thirds of the time. But as you can see, the losses have been relatively shallow, not exceeding 10%, while the gains have been good to extraordinary.

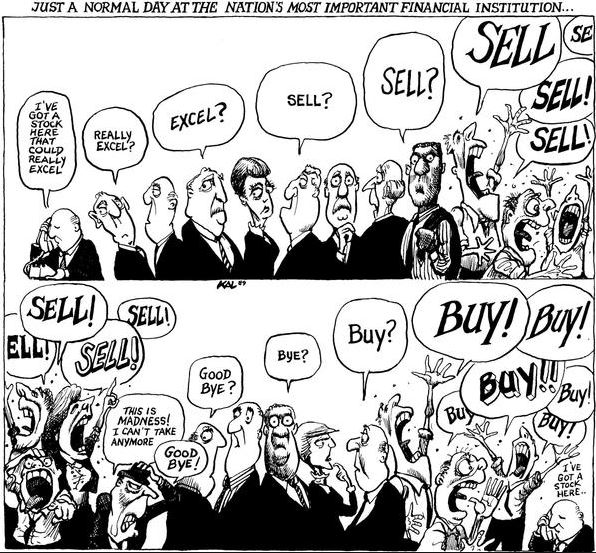

I like to say that the worst ten year period for any backtest is the next ten years, but I think that this simple trend following rule should continue to be effective in the future. The reason why trend following works with gold is because gold doesn’t trade on fundamentals, it trades on sentiment and emotion, which looks something like this.

I’m violating my own rules by talking about an investment publicly and I’ll admit that this is driven in part to protect my fragile ego. I want to show that I’m intellectually flexible, and that the trash I’ve talked about gold was targeted at the charlatans pumping it and not the asset itself. By following rules, however, I can eliminate the ego that is attached to public pronouncements. I view this purchase as a lottery ticket, with better odds. It has negative expected returns, but if it ends up in the black, it should be solidly gold.

I

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Now go talk about it.

Heightened risk appetite in the marketplace put gold prices under pressure Tuesday, but one analyst says all the uncertainty should continue to support the metal.

“Regardless of the short-term losses, the yellow metal remains heavily supported by geopolitical risk and political drama in Washington,” noted Lukman Otunuga, market analysts for FXTM, in a report Tuesday.

The gold market saw mild profit-taking as markets await the Jackson Hole Economic Policy Symposium scheduled later this week. Both Federal Reserve Chair Janet Yellen and European Central Bank president Mario Draghi are set to speak at the event on Friday. December Comex gold futures last traded down 0.37% at $1,291.90 an ounce.

However, the London-based analyst remains optimistic, noting that gold bulls still have an edge.

“There is still a lingering air of caution ahead of the Jackson Hole conference later this week and this should empower gold bulls,” he said.

“From a technical standpoint, the yellow metal is bullish on the daily charts, as there have been consistently higher highs and higher lows.”

The bulls remain in control above $1,283 an ounce, Otunuga continued, adding that a break above $1,293 would open the metal’s path towards $1,300.

Even if bitcoin – known to some as digital gold – is stealing the metal’s spotlight, one analyst points out that the cryptocurrency has a longs way to go before it catches up to bullion, at least in market cap.

In dollar terms, bitcoin has surpassed gold prices by a landslide, recently hitting an all-time high above $4,000; meanwhile, gold prices continue to hover near $1,300 an ounce.

However, if we look at the market cap of both these markets, gold is still king.

“It’s gold that could still mop the floor with bitcoin if we compare the two based on market cap,” wrote Sean Williams, a Motley Fool contributor since 2010, in a post Thursday.

“Despite its recent strength, this writer continues to believe that avoiding bitcoin is a smart move…We’ve witnessed numerous assets increase in value like this before throughout history, and practically every one wound up having its bubble burst eventually. My suspicion is bitcoin will be no different, and uninformed investors are going to be taken to the digital woodshed if they aren’t careful.”

Williams looked at data from Thomson Reuters GFMS and other sources to decipher just how much gold there is in order to determine the gold market’s market cap.

Based on a GFMS 2013 report, it is believed 171,300 tons of gold had been mined or was still in the ground. Based on current prices, that would mean gold’s implied market cap would land at a whopping $7.07 trillion.

“That’s more than 100 times the market cap of bitcoin at its all-time high!” Williams said.

However, according to other sources, the number could even be higher, he continued.

“It’s also worth pointing out that numerous reports exist on the world’s total gold supply, and some suggest as much as 2.5 million tons may be present (that’s over 14 times what Thompson Reuters has predicted),” he said. “This would imply a $103 trillion market value for gold, or nearly 1,500 times that of bitcoin. Long story short, bitcoin still has a very long way to go to truly catch gold.”

Williams also compared the digital currency’s market cap to that of the S&P 500 and the U.S. dollar, and found that bitcoin is trailing far behind.

(Kitco News) -Even if gold saw its steepest one-day drop in nearly six weeks on Tuesday, big shot investors aren’t giving up on the metal just yet with billionaire John Paulson among them.

Recent government filings showed that New York-based Paulson & Co. held onto its 4.36 million shares of SDPR Gold, the world’s largest gold-backed exchange-traded fund, at the end of June, unchanged from the first quarter.

Gold prices were volatile in Q2, almost breaching the key $1,300 level twice during that three-month period. Recently, the metal got a safe-haven bid almost reaching that key resistance level again, but found itself unable to break through it for the third time this year. December Comex gold futures settled the day nearly 1% lower Tuesday at $1,279.70 an ounce.

Despite the volatility, Paulson kept onto his gold bets, which aside from GLD included some mining companies. Topping the list was Vancouver-based Novagold Resources, followed by South African miner AngloGold Ashanti and Toronto-based IAMGOLD. At the end of June, Paulson & Co held 22 million shares, 12.78 million shares and 3.86 million shares in each of these miners, respectively.

Paulson is not the only billionaire investor betting on bullion. Last week, Bridgewater Associates’ Ray Dalio made the case for the yellow metal in a LinkedIn post, recommending investors allocate 5-10% of their portfolio in gold.

“Prospective risks are now rising and do not appear appropriately priced in,” he wrote.

“[I]f the above things go badly, it would seem that gold (more than other safe haven assets like the dollar, yen, and treasuries) would benefit.”

Based on a recent filing, Dalio’s hedge fund added over 577,000 shares of GLD to its portfolio.

(Kitco News) – Tiny specks of gold can help patients battle cancer, according to a new study from Edinburgh University.

The idea is that the precious metal can make other drugs prescribed to treat lung cancer more effective, the research stated.

Scientists worked to encase gold nanoparticles, which are microscopic pieces of the precious metal, in a chemical device and witnessed that they can accelerate other chemical reactions.

This discovery could potentially allow doctors to insert chemotherapy treatments directly into tumors, limiting the negative side effects on the human body.

“We have discovered new properties of gold that were previously unknown and our findings suggest that the metal could be used to release drugs inside tumors very safely,” said Dr. Asier Unciti-Broceta, who works at the University of Edinburgh’s Cancer Research U.K. Centre.

The experiments were conducted on zebrafish with researchers successfully in implanting a device inside their brains.

The team remains hopeful that they can tweak their technique to make it applicable to human treatments as well.

“There is still work to do before we can use this on patients, but this study is a step forward. We hope that a similar device in humans could one day be implanted by surgeons to activate chemotherapy directly in tumors and reduce harmful effects to healthy organ,” Dr. Unciti-Broceta explained.

This discovery could have wider implications, helping patients with other forms of cancer.

“In particular, it could help improve treatment for brain tumors and other hard-to-treat cancers. The next steps will be to see if this method is safe to use in people, what its long- and short-term side effects are, and if it’s a better way to treat some cancers,” said Dr Aine McCarthy, senior science information officer at Cancer Research U.K.

The scientific journal Angewandte Chemie published the study in its July issue. The study was done in collaboration with researchers from the University of Zaragoza’s Institute of Nanoscience of Aragon in Spain. It was funded by the Cancer Research U.K. and the Engineering and Physical Sciences Research Council.

(Kitco News) – It is no longer legal for employers to pay salaries in gold bullion, ruled an expert tax avoidance panel in the U.K.

This was a first attempt to use a new law to curb “morally repugnant” tax avoidance schemes, The Guardian reported.

The anti-abuse rule (GAAR) panel, which was put together by former chancellor George Osborne in 2013, announced its first ruling, concluding that paying employee wages in gold bullion is a “contrived” tax avoidance scheme used to “frustrate the intent of parliament,” which is working on fighting such illegal practices.

“It is abnormal for an employer to reward employees using gold,” the ruling said.

The decision frees U.K.’s HM Revenue and Customs (HMRC) to pursue cases against employers playing around with “artificial and abusive” gold bullion schemes.

HMRC cited instances where companies developed schemes that would hide remuneration to employees by conducting payments “via a series of transactions [of] buying and selling an asset, commonly gold bullion.”

“They have a theoretical obligation to pay the value of the asset to a trust at some point in the future – it is claimed that this obligation makes the payment non-taxable. However, in instances seen by HMRC so far, the individual has actually taken cash, thus supporting the HMRC view this is a payment of earnings,” the department said.

HMRC did not specify the exact number of cases it looked at, but warned that gold bullion avoidance schemes don’t work.

“Today’s publication has wide-reaching impacts and reinforces the power of the GAAR in tackling abusive tax avoidance,” HMRC said.

After analyzing the patterns, GAAR said in its ruling that there was “no reason for the steps to involve gold, other than for tax purposes,” adding that people tried to use loopholes in the anti-avoidance legislation.

“Had cash been used and gold not been involved, other than the saving of fees in relation to the purchase and sale of the gold, neither the company nor the employees would have been in a substantially different economic or commercial position … In our view the steps in this case involving gold are abnormal and contrived,” it said. “It should not come as a surprise that we conclude the steps taken are not a reasonable course of action.”

The Guardian quotes one known gold scheme, citing CCH Daily website: “Your company could buy a coin and use it as part payment of your wages, the value would be its cost and the balance of wages would be paid from the bank account. You could then sell your coin if you wanted to add to the money received from the company.”